Monthly Update: Multifamily

The Partnership sends updates for the most important economic indicators each month. If you would like to opt-in to receive these updates, please click here.

Estimated Read Time: 2 minute

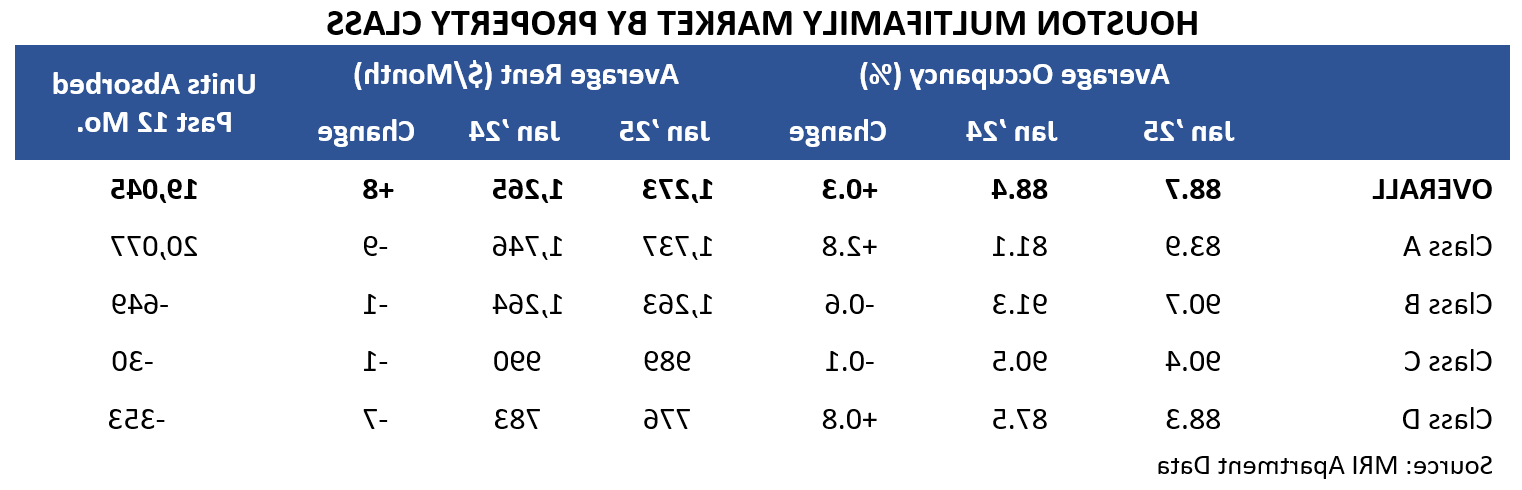

The multifamily market in metro Houston was stable in January ‘25, with modestly increasing occupancy and rents, and declining construction compared to last year. Overall apartment occupancy ticked up slightly from 88.4 to 88.7 percent between January ’24 and ‘25, according to MRI Apartment Data. Average rents increased by $8 during that time – a 0.6 percent change that is below the rate of inflation. Class A apartments are driving absorption, while all other classes are shedding occupied units.

Construction continues to taper off with only 13,536 new units underway as of late February. An additional 39,135 units across 126 properties are in the proposal stage of development.

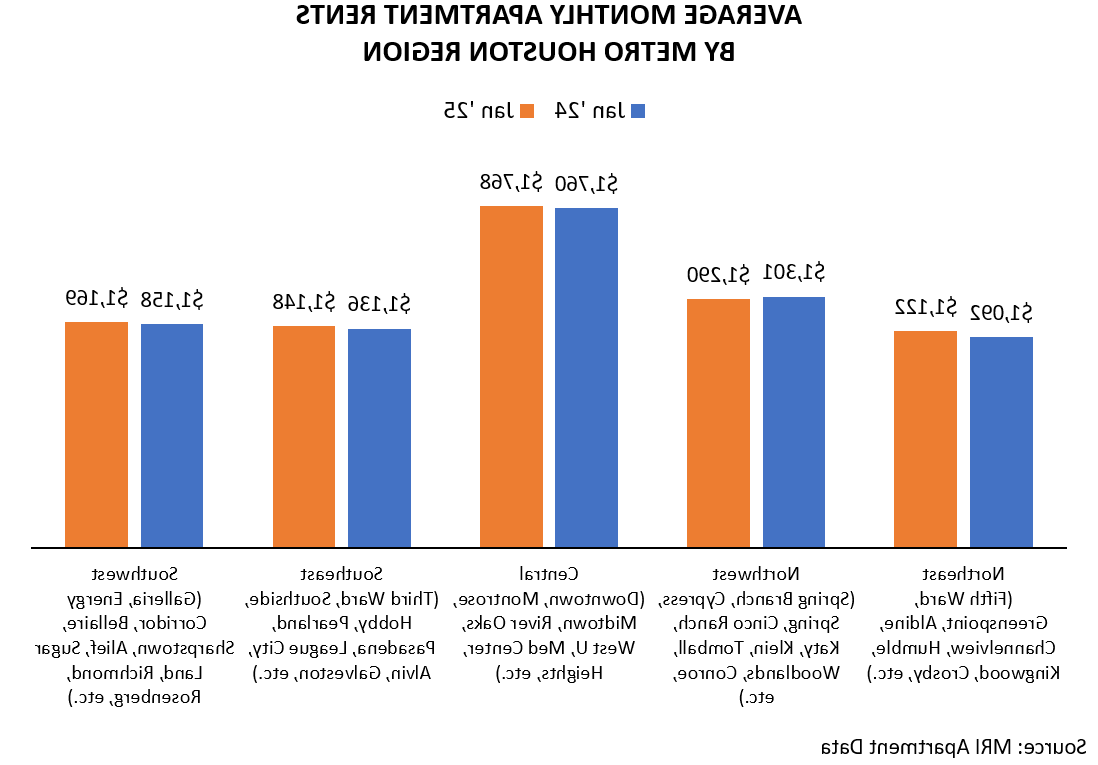

Rents remained relatively stable across metro Houston, declining year-over-year in the northwest while rising moderately in all other areas. The northeast experienced the largest price increase of $30 – but it remained the most affordable region for renters.

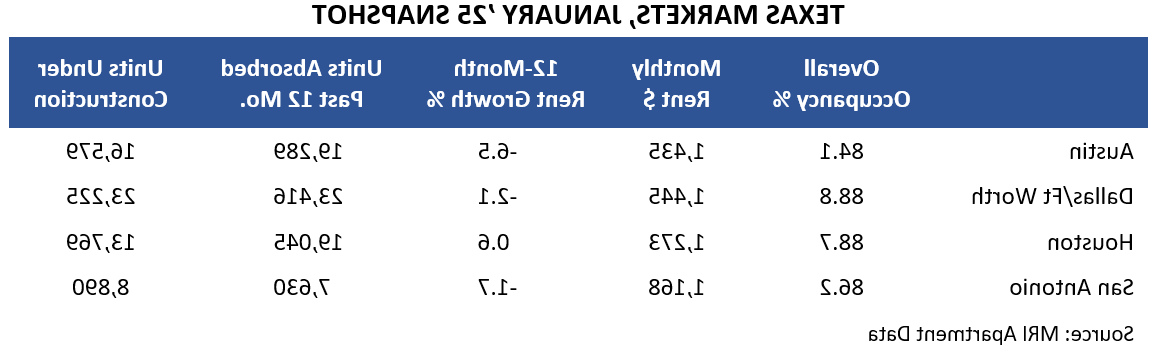

Other major Texas metro areas have seen rents and occupancy fall between January ’24 and ’25. Houston alone has seen occupancy and rents grow during that time (albeit at a modest pace). Even with its increasing prices, average rents in Houston are 11.3 percent lower than in Austin and 11.9 percent lower than in Dallas/Ft. Worth.

Prepared by Greater Houston Partnership Research Department

Colin Baker

Manager of Economic Research

Greater Houston Partnership

bakerc@achador.net

Clara Richardson

Analyst, Research

Greater Houston Partnership

crichardson@achador.net